Troubled Dublin City Schools ask county to help secure financing

County commissioner calls for entire school board’s resignation amid money troubles.

The Dublin City Schools appealed to the Laurens County Commission on Tuesday for help in securing a revenue bond deal that school officials say is needed to save the financially troubled district.

No vote was taken on the complicated and, according to the county attorney, possibly illegal proposal, but a majority of the commissioners were less than lukewarm to the idea, with one even calling for all members of the Dublin City Board of Education to step down.

“I know you didn’t do this on purpose, but it happened under their watch,” Commissioner Gerad Mathis said. “And I think, for me to authorize this board to go do that, the entire Dublin City school board needs to resign, tonight, and start over.”

State officials say the school system is on “a direct path to insolvency,” owing more than $6 million in overdue payments for employee benefits and facing a $13.4 million deficit when the fiscal year ends June 30, 2026. In the meantime, the school district had to get a $1.4 million advance of state QBE funding to meet last month’s obligations, including payroll.

The school district wants the county commission to reboot the inactive Laurens County Public Facility Authority to sell revenue bonds in which the school system would essentially sell and buy back an unnamed building. The authority was created by the General Assembly in 2001 as a “building finance vehicle” for the various governmental entities, and it played a role in financing the Dublin City Schools’ controversial solar panel project.

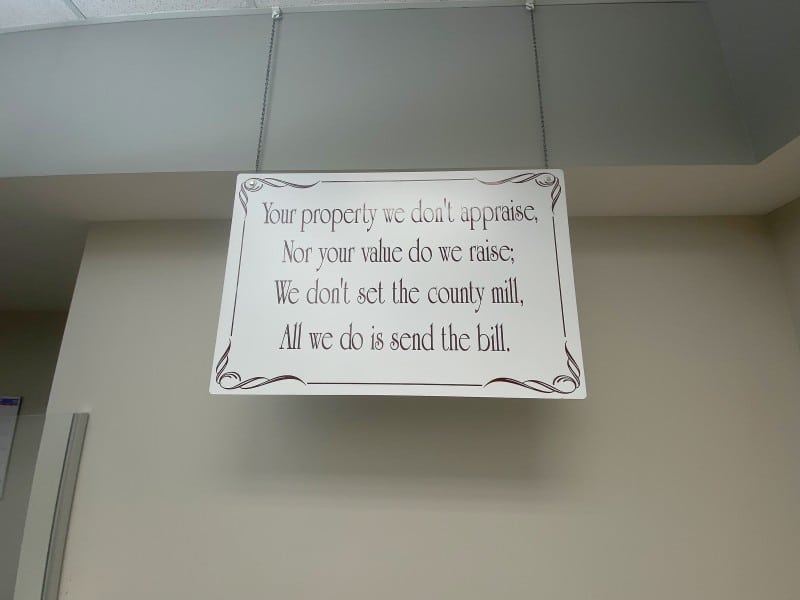

The only collateral in this latest deal would be the city school board’s authority to tax property owners at the maximum rate allowed of 20 mills.

Local school officials told the commissioners that without the revenue bonds, the end result will likely be consolidation of the city and county school systems.

“We have a mess. We feel like we should be the ones to clean up that mess,” interim Dublin School Superintendent Marcee Pool told the commission. “If we don’t get the bonds, we could be looking at consolidation.”

Pool said officials have been taking steps to reduce spending that include eliminating positions.

“We have been cutting positions,” said Pool. “We have cut a lot of positions for fiscal year ’26 and ’27, and are working on a balanced budget for ’27.”

Pool replaces former Superintendent Fred Williams, who took an early retirement last week. The system’s finance director, Chad McDaniel, resigned in late August, and former finance director Christi Thublin retired in 2024. The state has appointed a “special advisor” to help the system implement a deficit reduction plan and balanced budgets for the coming years.

Ben Lanier, the district’s Career, Technical, and Agricultural Education (CTAE) director, blamed the system’s “severe financial crisis” on “mismanagement” by former employees.

“They’re all gone,” he said.

Still, Mathis said he still could not support the bond deal unless the “new leadership” at the district includes a new school board.

“They’ve come here tonight and now they have made it a ‘commissioners’ problem’ at the city school system, in a way that they want us to save them. They’ve turned the tables to make it look like we’re the good guy or the bad buy,” said Mathis. “For years I have heard and seen the articles that raised financial questions about the school system, but their superintendent was on video saying to mind their own business and we’ll mind ours.’

“What I’ve heard tonight is their attorney ask the county commission to recreate this board to commit the taxpayers of the city of Dublin to pay 20 mills on a deficit, that’s what I heard, in layman’s terms. I’m not for consolidation, but at the same time I’m not for wasting these people’s money either. I know we have new people working in the office, but you have the same school board, maybe minus one member, and it happened on their watch.”

Commissioners Kevin Tanner and Jimmy Rogers both also said they would not support the revenue bond deal, citing County Attorney Billy Kight’s questions about its legality.

Commission Chairwoman Brenda Chain, however, said she would support it as long as the county is not responsible for the debt if not paid. “I think the Dublin City Schools can be fixed,” Chain said.

Earl Taylor, a revenue bond attorney speaking for the school board, said the county commission would not be obligated in any way.

“The only taxpayers on the hook would be the taxpayers of the city of Dublin,” Taylor said.

Taylor and the county’s attorney, Kight, had differing opinions on the legality of using the Public Facility Authority to secure the revenue bonds. Taylor encouraged Kight to read the local legislation that created the authority.

“I have read it. I drafted it for the commission in 2001.” Kight said. “Nowhere in here does it say anything about revenue bonds. What the city (school board) is trying to do has nothing to do with buildings.”

Kight said he believes the bond plan would not survive a court challenge. “I absolutely promise you it will be challenged,” he said.

“If they do they do,” Taylor said, “we will be ready for them.”

Several residents encouraged the commission to help avoid school consolidation, especially an unplanned one.

Lanier said a forced consolidation would open a “Pandora’s box of chaos” that would likely bring the U.S. Department of Justice here to redraw school districts and attendance zones.

Former Laurens County School Superintendent Bill Rowe said consolidation would cost the Laurens County Schools about $4 million in state funding. Once the city and county’s tax digests are combined, the system would no longer receive equalization funding because the combined district, for taxing purposes, would be considered too wealthy to qualify.

Taylor said the deal would require the city school board to enter an intergovernmental agreement with the authority, pledging to make the payments. “We would put a lien on that 20-mill limit,” he said.

Several commissioners were not comfortable in committing Dublin property owners to what would seem to be an automatic tax increase. Commissioner Kevin Tanner questioned how the school system will be able to cover its current debt, pay its operating expenses and pay off the proposed revenue bond.

“Their millage rate is almost maxed out now,” he said.

“It feels like we’re sort of meddling with the city of Dublin’s business,” said Mathis.

Doug Eaves, a consultant for local governments, expressed concerns about the proposal.

“This is a five- to 10-year problem. How are you going to correct a problem that started 10 to 15 years ago?” Eaves asked.

Commissioner Trae Kemp encouraged the commissioners to keep an open mind about the proposal, saying the Dublin City Schools’ problem is the community’s problem. Kemp explained he would recuse himself if the matter comes up for a vote, because of his job with Capital City Bank, where the city school system is a customer. He also said he would not benefit personally or professional in any way from the bond deal happens.

“The last thing I want to see happen is absolute pandemonium because something happens between now and Christmas where the city schools cannot make it, for whatever reason … and all of a sudden we’re in a hot mess because we’re trying to consolidate. I think that would be not only a disaster for the people of Dublin, but I think it would be a disaster for the people of Laurens County. If this happens, that will be a disaster for everyone.”

At the very least, Kemp said, the city, county and both school boards need to go to Atlanta together to “find a solution that works for everybody.”

“If we put our hands in the air and say this ain’t our problem, we’re lying to ourselves,” he said. “This is everyone’s problem. We’re all in this boat together. We sink or we swim, by God, together. If we can’t get together, whatever the outcome is, whether it’s consolidation or not, it is on us. And shame on us.”

Kemp and Mathis both have children in the county school system.

“The jury is still out with me,” Mathis said. “I have two daughters in the county school system. I have a lot at stake here, but at the same time I don’t feel I can obligate the Dublin taxpayers’ money on a system that I don’t know can fiscally make it five years.”